Crypto Taxation in Florida: Understanding the Need for a Crypto Tax Accountant

In recent years, cryptocurrencies have become increasingly popular, and Florida is no exception. With the rise of digital assets, there has also been an increase in the need for professional tax services for cryptocurrency traders and investors. A crypto tax accountant in Florida can help individuals and businesses stay compliant with state and federal tax regulations, as well as navigate the complex landscape of crypto taxation.

Cryptocurrency is a form of decentralized digital currency that operates independently of a central bank or government. While the decentralization aspect of cryptocurrencies can make it difficult to regulate and tax, the IRS has recently clarified its stance on cryptocurrency taxation. In short, the IRS considers cryptocurrencies to be property, not currency. This means that capital gains and losses tax regulations apply to cryptocurrency transactions.

In Florida, crypto tax law is subject to the same federal tax regulations as the rest of the country. Additionally, the state has not enacted any specific legislation relating to cryptocurrency taxation. This means that individuals and businesses must rely on federal tax laws when it comes to reporting cryptocurrency transactions and paying taxes.

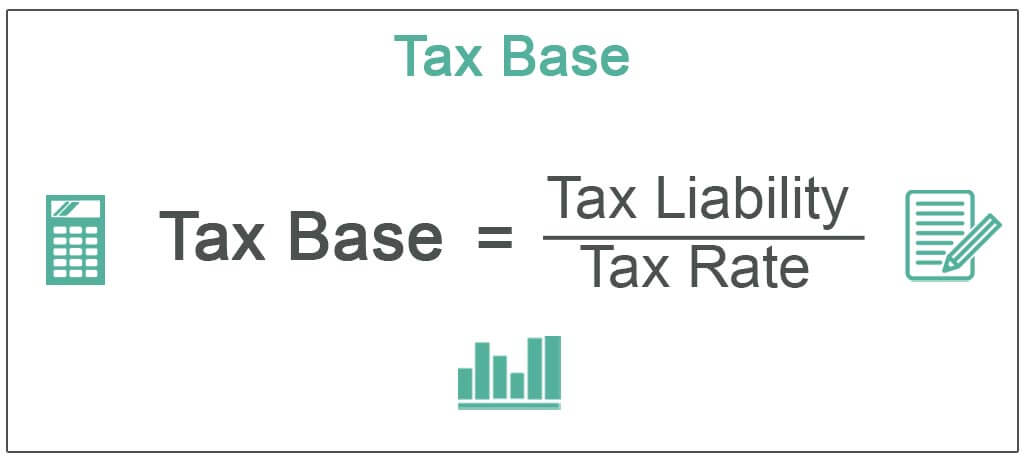

The process of calculating taxes

The process of calculating taxes on cryptocurrency transactions can be complex, and a professional crypto tax accountant in Florida can help you navigate the process with ease. They will be able to help you determine which transactions are taxable, how to calculate capital gains and losses, and what to report on your tax returns.

One of the most important things to consider when it comes to crypto taxation is record-keeping. Keeping detailed records of all cryptocurrency transactions is essential for accurately reporting gains and losses on your tax return. A crypto tax accountant in Florida can help you set up a record-keeping system that will make it easier to track your transactions and stay compliant with tax regulations.

Another important aspect of crypto taxation is determining the cost basis of your cryptocurrency holdings. This is the original purchase price of your cryptocurrencies, adjusted for any expenses related to acquiring or holding them. Cost basis is an essential factor in determining capital gains and losses when you sell or trade your cryptocurrency.

A crypto tax accountant in Florida

A crypto tax accountant in Florida can also help you with more complex tax issues, such as how to report crypto-to-crypto trades and how to calculate taxes owed on crypto mining activities. They can also help you navigate tax regulations related to Initial Coin Offerings (ICOs) and Security Token Offerings (STOs).

conclusion

In conclusion, as cryptocurrencies continue to grow in popularity, the need for professional tax services for cryptocurrency traders and investors will also grow. A crypto tax accountant in Florida can help individuals and businesses stay compliant with state and federal tax regulations, as well as navigate the complex landscape of crypto taxation. By working with a professional, you can ensure that you are accurately reporting your gains and losses and paying the correct amount of taxes owed.