In the ever-evolving landscape of personal finance, millennials find themselves at a unique crossroads. They are navigating a complex web of economic challenges, student loans, housing costs, and shifting job markets. As they strive for financial stability, setting realistic net worth goals becomes an essential part of the equation. In this blog post, we will explore the concept of net worth, why it matters, and how millennials can set achievable financial goals.

Understanding Net Worth

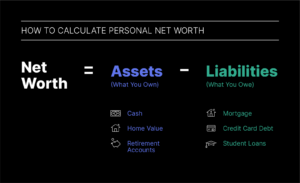

Before diving into goal-setting, it’s crucial to grasp what net worth actually means. Your net worth is the difference between what you own (assets) and what you owe (liabilities). Here’s a simple formula:

Net Worth = Total Assets Total Liabilities

Assets include items like:

- Savings accounts

- Investments (stocks, bonds, retirement accounts)

- Real estate

- Personal property (cars, jewelry)

Liabilities encompass:

- Student loans

- Credit card debt

- Mortgages

- Other loans

Calculating your net worth provides a snapshot of your financial health and serves as a baseline for future growth.

The Importance of Net Worth Goals

Setting net worth goals is not just about reaching a certain dollar amount; it’s about creating a roadmap for financial well-being. Here’s why it matters:

1. Motivation: Specific goals can inspire action. Knowing you want to reach a certain net worth can drive you to save more or spend less.

2. Progress Tracking: Goals help you measure your financial progress. Regularly checking your net worth can show you how far you’ve come and what adjustments you may need to make.

3. Financial Planning: Having clear goals allows for better financial planning. Whether you’re saving for a house, retirement, or a dream vacation, understanding your net worth can help you allocate resources more effectively.

4. Long-term Security: Setting goals encourages a focus on long-term financial health, rather than just immediate gratification.

Assessing Your Current Financial Situation

Before setting goals, it’s vital to assess your current financial situation. This involves calculating your net worth, understanding your income, expenses, and existing debts. Here’s a step-by-step approach:

1. Calculate Your Net Worth

Use the formula mentioned earlier. List all your assets and liabilities, and subtract your total liabilities from your total assets. This will give you your net worth.

2. Analyze Your Income and Expenses

Track your monthly income and expenses. Categorize them into fixed (rent, utilities) and variable (entertainment, dining out) expenses. This analysis will help you understand where your money goes and identify areas for potential savings.

3. Identify Your Debts

List all your debts, including interest rates and monthly payments. Understanding your debt situation is crucial for setting realistic goals.

Setting Realistic Net Worth Goals

Now that you have a clear picture of your financial situation, it’s time to set goals. Here’s how to make them realistic:

1. Establish Short-term, Medium-term, and Long-term Goals

Short-term Goals (1-3 years)

- Aim to build an emergency fund of 3-6 months’ worth of expenses.

- Pay off high-interest credit card debt.

- Increase retirement contributions to take advantage of employer matches.

Medium-term Goals (3-7 years)

- Save for a down payment on a house (typically 20% of the home’s price).

- Pay off student loans.

- Invest in a diversified portfolio to grow your wealth.

Long-term Goals (7+ years)

- Aim for a specific net worth that aligns with your retirement plans.

- Focus on financial independence, allowing for early retirement if desired.

2. Be Specific and Measurable

Set specific numbers for your goals. Instead of saying, “I want to save more,” specify, “I want to save $10,000 for a down payment by 2026.” This clarity will help you stay focused and motivated.

3. Create a Timeline

Assign timelines to each goal. This can create a sense of urgency and help you prioritize your financial decisions.

4. Make Your Goals Flexible

Life is unpredictable. Be prepared to adjust your goals based on changes in your circumstances. If you get a new job with a higher salary, for example, you may want to increase your savings rate.

Tools and Strategies for Achieving Your Goals

Setting goals is just the first step. Here are some tools and strategies to help you achieve them:

1. Budgeting

Create a realistic budget that reflects your income and expenses. Use apps like Mint or YNAB (You Need a Budget) to track your spending and stick to your goals.

2. Automate Savings

Set up automatic transfers to savings accounts or investment accounts. This “pay yourself first” approach can make saving easier and less painful.

3. Invest Wisely

Consider investing in a diversified portfolio that aligns with your risk tolerance. Look into index funds or ETFs for low-cost options. Over time, compounding interest can significantly increase your net worth.

4. Increase Income

Explore opportunities for increasing your income, whether through side gigs, freelancing, or seeking promotions. Investing in your skills can lead to higher earning potential.

5. Monitor and Adjust

Regularly review your net worth and financial goals. This will help you stay on track and make necessary adjustments based on your progress or changes in your situation.

Common Pitfalls to Avoid

While setting goals, be aware of common pitfalls:

1. Setting Unrealistic Expectations: It’s essential to be ambitious, but overly aggressive goals can lead to frustration. Aim for challenging but achievable targets.

2. Neglecting Debt: Focusing solely on savings without addressing high-interest debt can hinder your financial progress.

3. Ignoring Lifestyle Inflation: As income increases, spending often rises. Keep lifestyle inflation in check to maintain your saving momentum.

4. Comparison with Peers: Everyone’s financial situation is different. Avoid comparing your progress to others, and focus on your own journey.

Conclusion

Setting realistic net worth goals is a powerful tool for millennials striving for financial stability. By understanding your current situation, establishing clear and measurable goals, and employing effective strategies, you can create a roadmap to a healthier financial future. Remember, progress may not always be linear, but with dedication and the right approach, achieving your net worth goals is within reach. Start today, and take control of your financial destiny!