In the realm of personal finance, understanding your financial health is crucial. One of the best tools to gain insight into your financial standing is a personal net worth statement. This simple yet powerful document provides a snapshot of your financial situation, helping you make informed decisions about your money. In this blog post, we’ll guide you through the process of creating a personal net worth statement and explain why it matters.

What is a Personal Net Worth Statement?

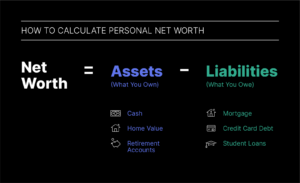

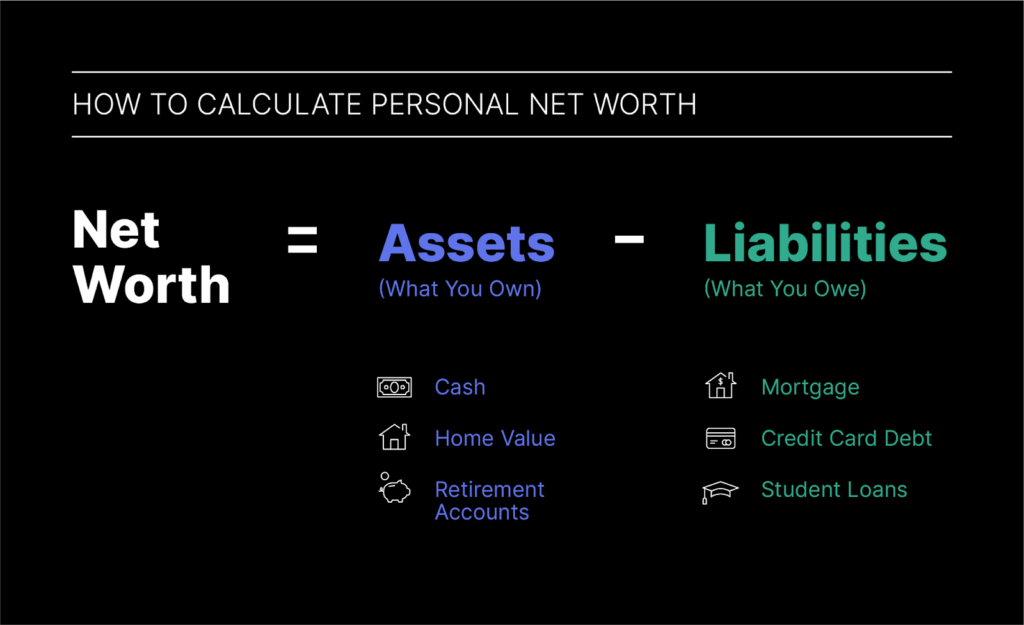

A personal net worth statement is a financial document that summarizes your assets and liabilities. By subtracting your total liabilities from your total assets, you can determine your net worth, which is a key indicator of your financial health. A positive net worth signifies that you own more than you owe, while a negative net worth indicates the opposite.

Why is a Net Worth Statement Important?

1. Financial Clarity: It offers a clear view of your financial situation, helping you understand where you stand.

2. Goal Setting: By tracking your net worth over time, you can set realistic financial goals and monitor your progress toward them.

3. Investment Planning: A net worth statement helps you make informed decisions about investments and savings, aligning them with your long-term financial objectives.

4. Debt Management: Understanding your liabilities allows you to create effective strategies for paying off debt.

5. Life Changes: Whether you’re buying a home, starting a family, or planning for retirement, a net worth statement provides valuable insight into your financial readiness for these milestones.

Steps to Create Your Personal Net Worth Statement

Creating a personal net worth statement involves a systematic approach. Here’s a step-by-step guide to help you get started:

Step 1: Gather Your Financial Information

Before you can create your net worth statement, you need to collect all relevant financial data. This includes information about your assets and liabilities. Here are some specific categories to consider:

Assets

1. Cash and Cash Equivalents

- Savings accounts

- Checking accounts

- Cash on hand

2. Investments

- Stock portfolios

- Bonds

- Retirement accounts (401(k), IRA)

- Mutual funds

3. Real Estate

- Current market value of your home

- Any investment properties

4. Personal Property

- Vehicles (cars, motorcycles)

- Valuable items (jewelry, collectibles)

5. Other Assets

- Business ownership

- Any other investments or assets you own

Liabilities

1. Debt Obligations

- Mortgage balances

- Student loans

- Car loans

2. Credit Card Debt

- Outstanding balances

3. Other Loans

- Personal loans

- Any other liabilities

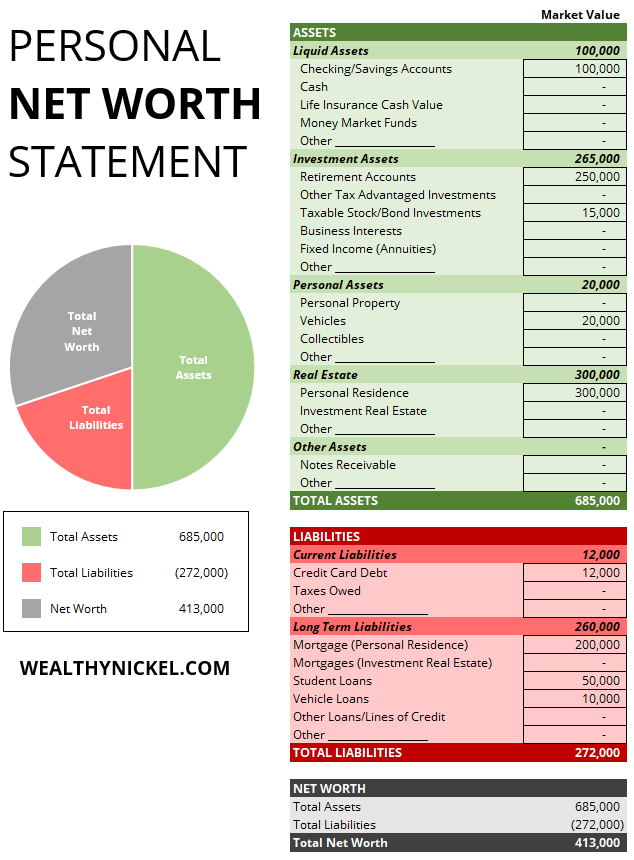

Step 2: Create Your Net Worth Statement Template

Now that you’ve gathered your financial information, it’s time to organize it into a clear and concise format. You can create your net worth statement using a simple spreadsheet or financial software. Here’s a basic template to follow:

Personal Net Worth Statement Template

Date: [Insert date]

Assets:

a) Cash and Cash Equivalents:

- Checking Account: $____

- Savings Account: $____

b) Investments:

- Stocks: $____

- Bonds: $____

- Retirement Accounts: $____

c) Real Estate:

- Primary Residence: $____

- Rental Properties: $____

d) Personal Property:

- Vehicle 1: $____

- Vehicle 2: $____

- Other Valuable Items: $____

e) Other Assets:

- Business: $____

- Other Investments: $____

Total Assets: $____

Liabilities:

- Mortgage: $____

- Student Loans: $____

- Car Loans: $____

- Credit Card Debt: $____

- Other Loans: $____

Total Liabilities: $____

Net Worth: $____ (Total Assets Total Liabilities)

Step 3: Fill in the Template

With your template in hand, start filling it out with the data you gathered in Step 1. Be as accurate and honest as possible to ensure that your net worth statement reflects your true financial situation. Here are some tips for this process:

- Research Current Values: For assets like real estate and investments, use current market values. Websites like Zillow for real estate or financial platforms for stocks can help.

- Be Comprehensive: Don’t overlook small assets or debts; they all contribute to your overall financial picture.

Step 4: Calculate Your Net Worth

Once you’ve filled in your assets and liabilities, calculate your total assets and total liabilities. Subtract your total liabilities from your total assets to determine your net worth. This number provides you with a clear indication of your financial health.

Step 5: Analyze Your Net Worth Statement

Now that you have your net worth statement, take some time to analyze it. Consider the following questions:

1. Is Your Net Worth Growing? Compare your current net worth with previous statements to see if you’re making progress.

2. What Are Your Major Assets and Liabilities? Understanding where your wealth lies and where your debt accumulates can help you make informed financial decisions.

3. Are There Areas for Improvement? Identify any liabilities that may be negatively impacting your net worth and strategize on how to reduce them.

4. What Are Your Financial Goals? Use your net worth statement as a foundation for setting short-term and long-term financial goals.

Step 6: Update Your Net Worth Statement Regularly

A personal net worth statement is not a one-time exercise; it’s a living document that should be updated regularly. Consider reviewing it quarterly or annually to track your financial progress and make adjustments as needed.

Step 7: Use Your Net Worth Statement for Financial Planning

Your net worth statement can be an invaluable tool for financial planning. Here are some ways to leverage it:

- Budgeting: Use your liabilities to create a budget that prioritizes debt repayment and saving.

- Retirement Planning: Assess if you are on track to meet your retirement goals based on your net worth and investment strategy.

- Investment Decisions: Determine how much you can afford to invest and in what areas based on your overall financial situation.

Common Mistakes to Avoid

While creating your personal net worth statement, be mindful of these common pitfalls:

1. Overestimating Assets: Ensure that you use current market values for your assets rather than inflated estimates.

2. Underestimating Liabilities: Be thorough in listing all debts. Ignoring small loans or credit balances can skew your net worth.

3. Neglecting to Update: Failing to update your statement regularly can lead to outdated information and poor financial decision-making.

4. Comparing with Others: Everyone’s financial journey is different. Focus on your progress rather than comparing your net worth to peers.

Conclusion

Creating a personal net worth statement is a fundamental step in taking control of your finances. It provides a clear snapshot of your financial health, helps you set realistic goals, and enables you to make informed financial decisions. By following the steps outlined in this guide and regularly updating your statement, you can gain valuable insights into your financial journey and work towards achieving your financial objectives. Start today, and take the first step toward a more secure financial future!