Your 30s can be a transformative decade, both personally and financially. As you navigate career advancements, family planning, and homeownership, it’s crucial to prioritize your financial health. Building and growing your net worth during this time sets the stage for future wealth and security. In this article, we’ll explore effective strategies to enhance your net worth in your 30s, ensuring that you are on a solid path toward financial success.

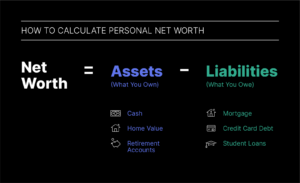

Understanding Net Worth

Before diving into strategies, let’s clarify what net worth is. Your net worth is the difference between what you own (assets) and what you owe (liabilities). It’s a snapshot of your financial health at any given moment. Understanding how to increase your net worth involves focusing on both sides of the equation: growing your assets and managing your liabilities.

Why Your 30s Matter for Net Worth Growth

1. Compounding Interest: The earlier you start saving and investing, the more time your money has to grow through the power of compounding.

2. Career Development: Many individuals see significant career advancements and salary increases during their 30s.

3. Debt Management: This decade is often when individuals begin paying off student loans and other debts, making it a critical time for financial stability.

Strategies for Increasing Your Net Worth

1. Create a Comprehensive Budget

A solid budget is the foundation of financial management. Here’s how to create one:

- Track Income and Expenses: Use apps or spreadsheets to log all sources of income and monthly expenses.

- Categorize Spending: Divide expenses into needs (essentials) and wants (discretionary spending).

- Set Financial Goals: Identify short-term and long-term financial goals, such as saving for a home or retirement.

Action Step:

Review your budget monthly to adjust for changes and ensure you’re on track.

2. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can safeguard your finances against unexpected expenses. Aim for:

- 3-6 Months’ Worth of Expenses: This fund should cover essential living expenses, providing a buffer in case of job loss or emergencies.

- High-Interest Savings Account: Store your emergency fund in a separate, high-yield savings account to earn interest while keeping it accessible.

Action Step:

Automate transfers to your emergency fund each month to ensure consistent growth.

3. Pay Off High-Interest Debt

Debt, especially high-interest debt like credit cards, can significantly hinder net worth growth. Here’s how to tackle it:

- Prioritize Payments: Focus on paying off high-interest debts first using strategies like the avalanche or snowball method.

- Negotiate Lower Rates: Contact creditors to negotiate lower interest rates or explore balance transfer options.

Action Step:

Create a debt repayment plan and track your progress to stay motivated.

4. Invest for the Future

Investing is essential for long-term net worth growth. Here’s how to get started:

- Contribute to Retirement Accounts: Take advantage of employer-sponsored retirement plans, such as a 401(k). Aim to contribute enough to get any employer match—it’s essentially free money.

- Explore Individual Retirement Accounts (IRAs): Consider a Traditional or Roth IRA for additional tax-advantaged retirement savings.

- Diversify Investments: Invest in a mix of assets, including stocks, bonds, and real estate, to spread risk and enhance potential returns.

Action Step:

Set a goal to increase your investment contributions by a small percentage each year.

5. Increase Your Income

Boosting your income can accelerate net worth growth. Consider the following strategies:

- Ask for a Raise: If you’ve been performing well, don’t hesitate to request a salary increase during performance reviews.

- Pursue Side Hustles: Explore freelance opportunities or part-time work in areas you’re passionate about. This extra income can be directed toward savings or investments.

- Invest in Education: Consider taking courses or obtaining certifications that can enhance your skills and potentially lead to promotions or higher-paying jobs.

Action Step:

Research local job markets and industries to identify opportunities for career advancement.

6. Buy a Home Wisely

Homeownership can be a significant asset, but it’s important to approach it thoughtfully:

- Research Markets: Buy in areas with potential for appreciation. Analyze local real estate trends and future development plans.

- Get Pre-Approved: Before house hunting, get pre-approved for a mortgage to understand your budget and strengthen your negotiating position.

- Consider Resale Value: Choose properties that are likely to appreciate or are in desirable locations for future resale.

Action Step:

Work with a knowledgeable real estate agent who understands your financial goals.

7. Automate Savings and Investments

Automating your finances can simplify the process of building wealth. Consider these automation strategies:

- Direct Deposit: Set up direct deposits to your savings and investment accounts as soon as you receive your paycheck.

- Automatic Transfers: Schedule automatic transfers from your checking account to savings and investment accounts monthly.

Action Step:

Review your automatic transfers regularly to ensure they align with your financial goals.

8. Educate Yourself Financially

Knowledge is power when it comes to financial management. Enhance your financial literacy by:

- Reading Books and Articles: Explore reputable finance books, blogs, and articles to expand your understanding of personal finance and investment strategies.

- Attending Workshops and Webinars: Participate in local or online financial literacy workshops that cover topics like budgeting, investing, and retirement planning.

- Listening to Podcasts: There are numerous finance-focused podcasts that offer valuable insights and tips for wealth building.

Action Step:

Set a goal to read one finance-related book or attend a workshop each quarter.

9. Network and Build Relationships

Networking can open doors to new opportunities that can enhance your net worth:

- Attend Industry Events: Join professional organizations and attend conferences relevant to your field.

- Leverage Social Media: Use platforms like LinkedIn to connect with industry professionals and expand your network.

Action Step:

Schedule regular networking activities, whether virtual or in-person, to maintain and grow your professional connections.

10. Review and Adjust Regularly

Your financial situation and goals will evolve over time, making it essential to review and adjust your strategies:

- Annual Net Worth Assessment: Calculate your net worth annually to track progress and identify areas for improvement.

- Goal Adjustment: Reassess your financial goals annually to ensure they align with your current situation and aspirations.

Action Step:

Schedule a financial review at the end of each year to assess your progress and set new goals.

Conclusion

Your 30s are a pivotal decade for financial growth and building your net worth. By implementing these strategies—creating a budget, building an emergency fund, paying off debt, investing wisely, and increasing your income—you can establish a solid financial foundation for the future. As you navigate this exciting period of life, remember that consistency and education are key. By actively managing your finances and making informed decisions, you can set yourself up for lasting success and security. Embrace the journey, and watch your net worth grow!